The latest research by estate agent comparison site, GetAgent.co.uk, has highlighted which UK regions are predicted to benefit from the greatest level of house price appreciation by 2024.

A recent market forecast by a wealth of industry experts, including the OBR (Office for Budget Responsibility), Savills, and Knight Frank, concluded that house price growth should increase by a further 14.5% across the UK by 2024, but what does this mean for UK homeowners?

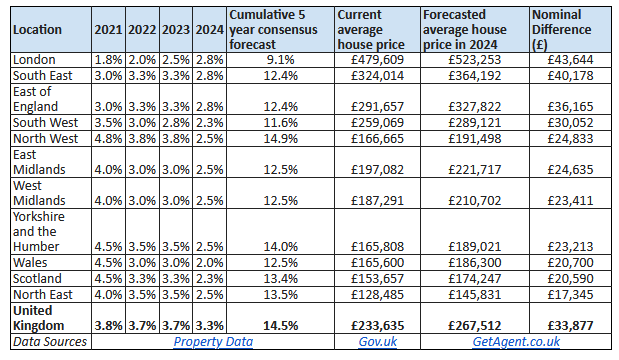

With a current UK average house price of £233,512, this 14.5% uplift would see a further £33,877 added to the property price of current UK homeowners.

The North West and Yorkshire and the Humber are due to see the largest percentage uplifts in house price at 14.9% and 14% respectively. This equates to a house price increase of £24,833 by 2024 in the North West and £23,213 across Yorkshire and the Humber.

At 9.1%, London is expected to see the lowest rate of property price growth by 2024. However, with the average house price in the region currently at £479,609, the capital’s homeowners will enjoy the largest monetary increase in values with a jump of £43,644.

The South East will also see one of the biggest monetary increases up £40,178 from £324,014 today.

While the North East is expected to see a healthy uplift of 13.5% in property values over the next four years, homeowners will see the smallest actual uplift in values. The current average house price in the region sits at £128,485, meaning a 13.5% increase will add £17,345; boosting property prices to £145,831.

Founder and CEO of GetAgent.co.uk, Colby Short, commented:

“The property market is booming at present, however, the huge rates of growth currently being seen are likely to subside over the coming months. Particularly as we approach the stamp duty holiday deadline.

That said, the long-term view of the market is good and the general consensus is that a more subdued but stable rate of growth should prevail.

While this will result in a slower rate of house price growth to what we’re seeing currently, it should ensure positive movement across the UK market, with house prices increasing substantially regardless of where you live.”